Oerlikon engineers’ equipment, materials and surfaces providing expert services to enable customers to have high-performance systems and products with extended lifespans.

Following the IPO, the Drive Systems Segment of Oerlikon Group will operate as GrazianoFairfield AG. Based on approx. 100 years of experience, GrazianoFairfield is a leader in providing high-performance gears, power transfer units (PTUs), market-leading shifting solutions, differentials, planetary drives and innovative solutions for e-drives and hybrids. Leveraging the secular trends of increasing demand for smarter mobility, higher product standards and improved energy efficiency, the company has successfully established a strong base of customers in the automotive, agriculture, transportation, energy (oil & gas/mining) and construction industries.

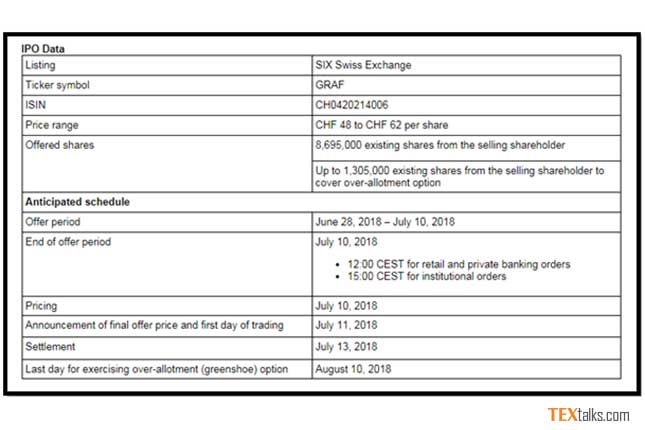

- IPO price range is from CHF 48 to CHF 62 per share

- Listing and commencement of trading on SIX Swiss Exchange expected to take place on July 11, 2018 under the ticker symbol GRAF

- Free float expected to comprise 87 % of the shares in GrazianoFairfield, or 100 % if the over-allotment option is exercised in full

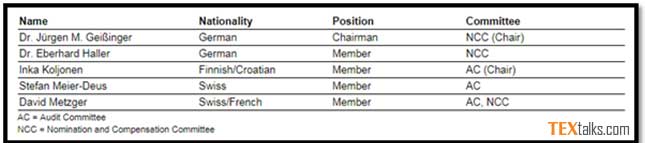

- Highly experienced and independent Board of Directors of GrazianoFairfield confirmed

- Oerlikon Group on track in strategy execution, forging ahead focusing on surface solutions and manmade fibers businesses

The offered shares will be priced between CHF 48 and CHF 62 per share, corresponding to an expected market capitalization in the range of CHF 480 million to CHF 620 million.

The offered shares will be priced between CHF 48 and CHF 62 per share, corresponding to an expected market capitalization in the range of CHF 480 million to CHF 620 million.

The book building process begins, June 28, 2018, and trading is expected to start on July 11, 2018 under the symbol “GRAF” and the ISIN CH0420214006. Around 87 % of shares in GrazianoFairfield will be placed representing 8,695,000 existing shares. UBS, as Sole Global Coordinator, has been granted an over-allotment option of up to 15 % of the offered shares (that is, 13.05 % of the overall share capital), exercisable within 30 days following the first day of trading. If the greenshoe (over-allotment) option is fully exercised, the free float will increase to 100 %.