The year 2022 has been a year of turmoil and uncertainty for cotton. The unstable cotton prices kept the spinners on their toes.

The uncertainty on the production side was caused by drought, flooding, and pest infestation. Usually, cotton farmers have to fight against pests’ attacks only. The uncertainty in consumption patterns was due to high price fluctuations, and lower demand as consumers’ pockets were hit by high inflation the world over. The ongoing Russia-Ukraine war also contributed to uncertainty.

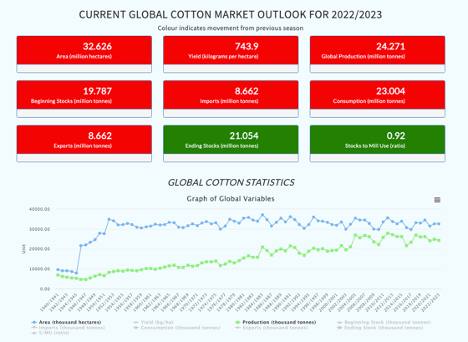

Cotton buyers did not rush to buy the commodity despite fears of the lower crop. According to the International, Cotton Advisory Committee estimates the cotton consumption this year would be restricted to 23 million tons while the total crop size has been estimated at 24.2 million tons. This will result in a carryover of 1.2 million tons for the next year.

Cotton prices remained relatively stable during the week. But the prices fluctuated from 125 cents per pound to 85 cents per pound during the year. For the next year, the ICAC predicts that prices may range from 97.9 cents to 151 cents per pound. This again points to high expected volatility. The midpoint price is estimated at 115 cents per pound which is almost 30 percent higher than current rates. Cotton was sown in 2022-23 over 32.626 million hectares and the average yield was 734.9 kg per hectare which resulted in total production of 24.271 million tons.

Price fluctuations of this magnitude are worrisome for spinners the world over. The normal practice in Bangladesh, Vietnam, and Indonesia is to procure the total cotton requirements at the start of the season against bank loans as these countries do not produce cotton. In India and Pakistan where domestic cotton is available, the bigger players stock the cotton for the whole year as they have bank finances available but the smaller mills that operate with an average of 20000 spindles most of the time procure cotton from the local market on weekly basis (some buy on daily basis due to financial constraints).

Usually, those that buy in bulk are in the driving seat as the prices are softer when more crops enter the market during peak harvesting. But if the prices drop in the middle of the season (which is rare) the big players face trouble as most did the world over including Pakistan. The small mills procuring on a weekly basis usually buy at higher rates as the season progresses but this year they could buy cotton at lower rates when prices dropped.

But the story does not end here. The depression in the global textile market affected the sales of all mills. The large mills and the smaller ones are sitting on large unsold stocks of yarn the world over including in Pakistan. Most are not in a position to buy cotton even at low rates. The larger mills are in greater trouble because whatever yarn they produce from cotton bought at high rates will have to be sold below cost.