International Textile Manufacturers Federation (ITMF) is an international forum for the world’s textile industries, dedicated to keeping the worldwide membership constantly informed through surveys, studies, and publications, participating in the evolution of the industry’s value chain and through the organization of annual conferences as well as publishing considered opinions on future trends and international developments. Through ITMF, the textile industries cooperate internationally with organizations representing other sectors allied to their industry.

ITMF has conducted its 11th ITMF Corona-Survey to analyze the global textile business situation and expectations. More than 330 companies worldwide in all segments along the textile value chain. For the fourth time since May, companies were asked the same set of questions about their 1) business situation, 2) business expectation, 3) order intake, 4) order backlog, and 5) capacity utilization rate. In a previous survey during 2020, ITMF reported that the textiles orders dropped 41% globally; and the global turnover in 2020 was down by 33% compared to 2019.

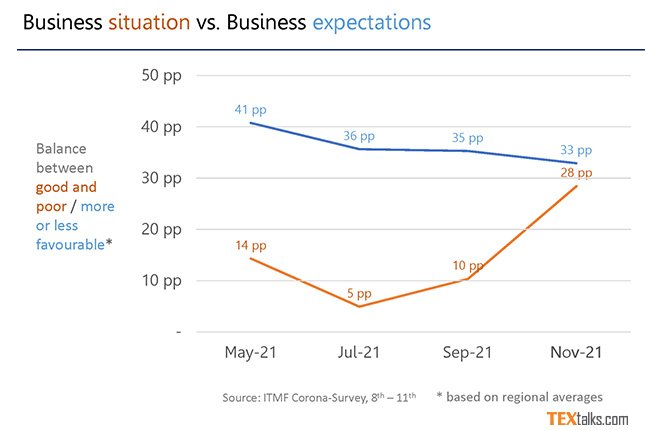

On average, the business situation has improved significantly since the 10th survey in September across all regions and segments. The balance between good and poor business companies jumped from +10 percentage points (pp) to +28 pp (see graph below). When it comes to business expectations in six months (May 2022), the balance is +33 pp. This means that significantly more companies expect business to be more favorable than less favorable by May 2022. Nevertheless, expectations were slightly higher in the previous surveys. Looking at the different regions reveals that the business situation improved on average in most regions except East Asia, and business expectations are optimistic in all regions.

As for the different segments, the gap between the upstream segments – fiber producers, spinners, and textile machinery producers, on the one hand, and the downstream segments, including weavers/knitters, finishers/printers, and garment producers, on the other hand, is narrowing. As far as order intake is concerned, the very favorable situation (+40 pp) is the source for the abovementioned ideal business situation. Order intake expectations increased again from an already high level to +41 pp.

Order backlog has remained almost unchanged since May and is around 2.5 months. By nature, the textile machinery segment has, on average, a much longer backlog (6 vs. 1.5 months for spinners). The capacity utilization rate has increased slowly but continuously since May 2021, indicating that the supply chain disruption is still a significant – but hopefully diminishing – concern.

The European Apparel and Textile Confederation (EURATEX) presented its survey on the 11th October 2021, which showed a similar trend to ITMF. In quarter-on-quarter terms, the EU turnover showed improvements across the sector. The textile turnover increased by +3.3% in Q2 2021, after slightly contracting in Q1 2021. Similarly, the business activity in the clothing sector expanded by +7% in Q2 2021, after increasing by +1% in the previous quarter. In the 2nd quarter of 2021, the EU-27 trade balance for T&C improved, resulting primarily from an increase in export sales across third markets and a drop in textile imports. T&C Extra-EU exports boomed by +49% compared with the same quarter of the previous year. T&C Extra-EU imports went down by -26% compared with the same quarter of the previous year, following a decrease in imports from some central supplier countries. EU imports from China and the UK collapsed due to Brexit and weaker demand in Europe.

However, this fragile recovery is hampered by higher shipping costs and increases in raw materials and energy prices. The cost of energy, in particular gas, has increased more than three times since the beginning of this year. Since the announcement of the EU’s “Fit for 55” package, we have seen CO2 prices rising above €60. This inevitably impacts the industry’s competitiveness, especially in a global context. The future recovery is also threatened by factors limiting production, such as shortage of labor force and equipment, which put additional pressure on T&C industries.