All Pakistan Textile Mills Association (APTMA) defended the high yarn prices in a press conference yesterday. APTMA said that failure to hedge against exchange rate fluctuation is a business decision, and neither the Government nor anyone else can be held responsible. It is deplorable that some of the smaller trade associations have politicized a purely economic issue.

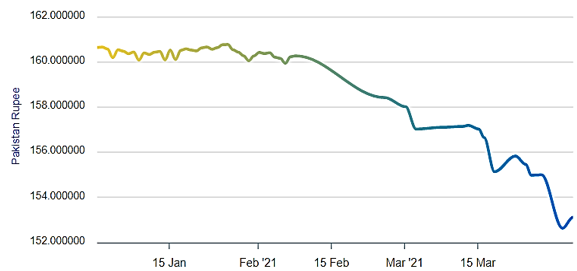

The actual financial problem that has caused such an uncalled outburst is the revaluation of rupee from 165 to 152 to a dollar that has squeezed the entire value chain’s profitability, including the yarn manufacturers, as explained below:

• Monthly yarn production is 200,000 tons with a consumption of 1.3 million bales per month. Out of which, only 6 million bales were produced domestically. The balance had to be imported at international prices from USA, Brazil, and West Africa to keep 200,000 tons of Yarn constant. The spinning industry consumes 100 percent of 30,000 tons of Synthetic fibers produced in the country. About 200,000 yarn is produced from cotton and synthetic fibers monthly, out of which only 100,000 tons of yarn is consumed by value-added per month. Balance is surplus exported in 60,000 tons of fabric and 40,000 tons of yarn every month. Therefore, there is no shortage of yarn or fabric, as it is already in surplus.

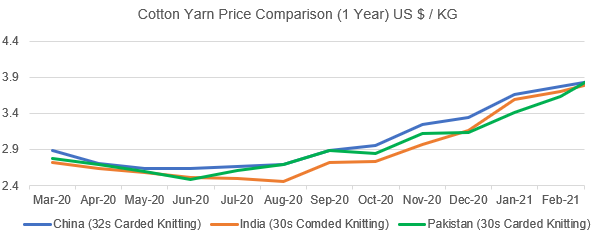

• It is utterly baseless that yarn rates are above international rates. The export sector already has the facility to import yarn to re-export products free of duty from anywhere in the world except India.

• The value-added sector would not reach out to the Government for additional support as the Export Refinance is available to the value-added industry at a mere 3% and should have been spent on purchasing yarn and cloth. The value-added sector has acquired rs. 1 trillion in the name of Export Refinance for yarn procurement that would have given them enough stock for at least 6 months. But there is no stock of yarn or fabric currently available, with the companies suggesting that the funds were utilized elsewhere. Export Refinance availed by the value-added sector must be audited to see whether the credit is being used for the purpose it was meant to be.

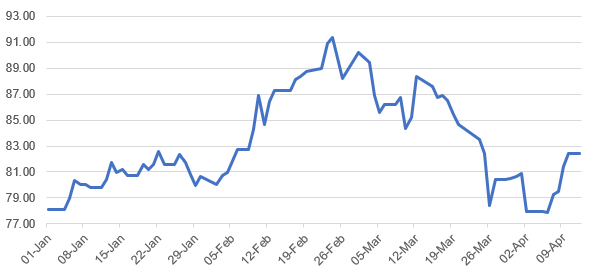

• Spinners imported cotton when cotton prices were high (90 cents/lb) and the exchange rate was 165. Currently, cotton is at 80 cents, and the exchange rate is 152. The combined effect is that raw material (cotton) that has been imported is 22% more expensive. Still, the yarn manufacturers had to adjust pricing in line with the lower cotton price and exchange rate, taking a hit of approximately 10% on yarn’s realized value. In a business that is volume-based with small margins, large-scale unforeseen appreciation has wiped out profitability. Failure to hedge against exchange rate fluctuation is a business decision, and neither the Government nor anyone else can be held responsible.