ATPMA also extended its gratitude to the Federal Minister for Energy Mr. Muhammad Ali wherein he has taken cognizance of the high power tariffs and their negative fallouts, and has taken up the task to restructure power tariffs that have prompted a country-wide wave of deindustrialization. Furthermore, APTMA urged him to expedite the reform process considering the gravity of the situation.

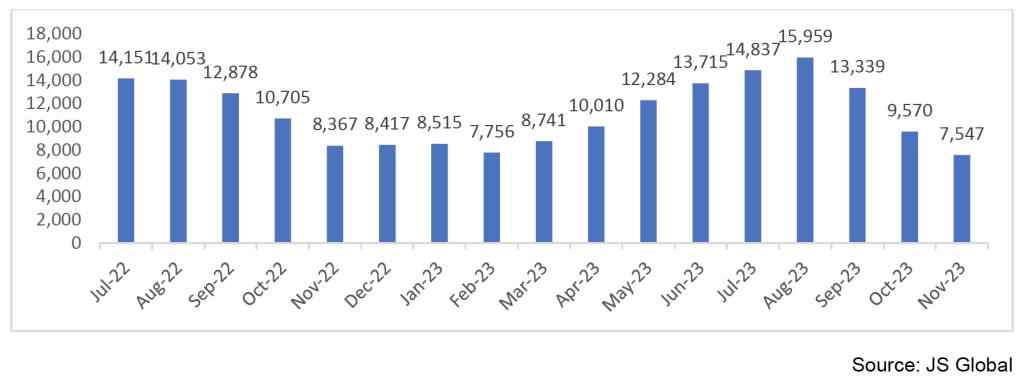

As per a recent report from JS Global, power generation in Pakistan is at a 33-month low (Figure 1).

Figure 1. Pakistan Power Generation (GWh)

Power consumption of APTMA member-firms was down 37% year-on-year in October 2023 across all DISCOS (Table 1).

Table 1. Monthly Power Consumption of APTMA Member-Firms

Similarly, power consumption for the first 20 days of December 2023 has declined by 26% year-on-year for industrial consumers and by 8% for domestic consumers on the LESCO network, driven by a decline in high-end domestic consumption.

This dramatic decline in power consumption is the direct result of irrational decision making in the power division that has pushed power tariffs to levels where neither industrial nor residential consumers are able to sustain their levels of consumption and demand for power is becoming increasingly elastic to prices.

In export-oriented sectors, production is not feasible at current power tariffs that are almost twice the average faced by competing firms in regional economies like India, Bangladesh and Vietnam. Economic inefficiencies like cross subsidies and stranded costs embedded in power tariffs cannot be passed on to international consumers who have several lower price alternatives available to them in international markets, thus rendering Pakistan’s exports uncompetitive.

For domestic industries, the power sector’s rationale—as indicated in various documents including the DISCOs’ petitions on determination of UoSC/Wheeling Charges—is that these industries can pass on the high electricity costs to their respective customers. However, the economy has witnessed and continues to witness unprecedented inflation of as much as 40% that—in-part driven by increasing energy prices—has severely eroded purchasing power. On one side, power tariffs are being increased for domestic sectors and on the other side they are also being forced to bear the impact of higher energy prices for industrial consumers in everything they purchase, resulting in a severe reduction in demand for domestically produced goods that has forced large production cuts and reduced industrial power consumption, causing loss of employment and further reductions in purchasing power.

The fall in the domestic sector’s power consumption is all the more worrying because it is driven by a fall in power consumption of high-end domestic consumers. Given that industrial and high-end domestic consumers are major contributors of power sector revenue, especially the inter- and intra-DISCO cross-subsidization, this decline in consumption is expected to cause huge losses to an already financially unsustainable and debt-ridden power sector.

These losses will necessitate a high Quarterly Tariff Adjustment (QTA) for Q2FY23, thereby further increasing already-high power tariffs that are responsible for the decline in consumption in the first place. Based on prevailing consumption trends, our estimates suggest that the QTA for Q2FY23 will be approximately Rs. 6/kWh, taking the total power tariff for industrial consumers to approximately Rs. 54.5/kWh (19.5 cents/kWh), not including the various duties and taxes:

Base Tariff (Rs/kWh) | 43 |

| Fuel Price Adjustment (Rs/kWh) | 4 |

| Quarterly Tariff Adjustment (Rs/kWh) | 6 |

| Additional Surcharge (Rs/kWh) | 1.5 |

| Power Tariff (Rs/kWh) | 54.5 |

| Power Tariff (cents/kWh) | 19.5 |

There should be no doubt that such a high power tariff will further accelerate the pace of economic deterioration, leading to a drastic reduction in industrial activity and loss of millions of jobs.

Irrational power tariff policies have created a vicious cycle of high power tariffs causing consumption to decline, necessitating further hikes in the power tariff that further reduce consumption and so on. If we continue on this trajectory, electricity tariffs will soon reach Rs. 100/kWh, consumption will continue to fall and even then, power tariffs will need to be increased.

If power tariffs had been maintained at around Rs. 35/kWh, our estimates suggest that industrial power consumption would have reached over 30,000 GWh annually and contributed over Rs. 1 trillion to power sector revenue, compared to only around Rs. 894 billion at current consumption and tariff levels where most of the reduction in revenue can be attributed to a lower industrial contribution to fixed costs of the system.

This misadventure has had very serious and dangerous implications for the entire economy. According to the IMF, Pakistan’s gross external financing requirements are projected at well above $25 billion annually for the next 5 years. In simple terms, this is over $125 billion in foreign exchange that the economy needs to spend on servicing its debt and financing its imports over the next 5 years but is money it does not have.

There are only 3 possible ways to meet this shortfall. First is through a significant and sustained increase in exports that remain down 10% for M11CY23 compared to the same period last year with no outlook for recovery under present circumstances. The second is through remittances that—according to a recent report in the Business Recorderi—the World Bank has projected will drop to $24 billion in 2023 and further down to $22 billion in 2024. Third is through external financing—either in the form of external borrowing or foreign direct investment. However, we have seen throughout the year that very few bilateral partners and multilateral institutions are willing to lend to or invest in Pakistan largely because of the poor business environment and bleak outlook for economic growth fostered by policies such as those of the Power Division.

In any case, Pakistan is not in a position to take on additional foreign currency debt as we continue to face a near-default situation that is nowhere near improving in the near-term. Industry is shutting down and even independent organizations like the Pakistan Institute for Development Economics have warned that the high price of energy is causing premature deindustrialization across the country and especially in Punjab.

If the status quo is maintained, manufacturing in Pakistan will become financially unviable, industry will come to a grinding halt with implications for millions of direct and indirect jobs in upstream and downstream sectors, including agriculture and retail, and loss of millions of livelihoods.

As unemployment and poverty increase further, an increasing number of households will be pushed into the lifeline and protected power tariff categories, causing a significant shift in the power sector and overall government’s revenue dynamics that the system is not equipped to handle. 4

The government must carefully review power tariff policies to reverse the incoming catastrophe. Power tariffs must be reassessed and revised to an economically optimal level that increases power consumption and power sector revenue.

A rational tariff for industrial consumers will stimulate industrial activities across the economy, increase power consumption and allow for a sustainable and financially viable power sector. It will also create incentives for industry to move away from RLNG/gas-based captive generation, freeing up indigenous resources and bringing down the energy import bill. Growth in industrial activity, especially in export sectors, will also revive millions of jobs and potentially add millions more to create income and allow households to come out of lifeline and protected categories, further increasing power sector revenue and reducing the quantum of cross subsidization.

However, the power division’s current policies—like most other policies, and especially those on taxation—are built on the philosophy of taking an ever-increasing share of an ever-shrinking pie by squeezing those who are productive to the point that there is no benefit in being productive and no one is willing to work because they know that whatever they make, the government will take from them in one way or another to finance its own shortcomings.

It is necessary to reiterate that the economy is stuck in a vicious cycle where ever-increasing power tariffs are causing power consumption to decline continuously to the point where Pakistan will have power companies but no consumers for them to cater to. The only way to come out of this cycle is to rationalize power tariffs at levels that stimulate the economy and allow for sustained levels of higher power consumption and therefore higher power sector revenue.

In this regard, we recognize the Federal Minister for Energy Mr. Muhammad Ali’s ongoing efforts to resolve this situation. According to a recent report in The Newsii, the Minister is cognizant of the dangerous dynamics at play in the power sector and the serious implications this poses for the overall economy. He is accepting of the fact that exports cannot thrive with cross subsidies and other inefficiencies embedded in power tariffs for export-oriented firms and that these components must be rationalized to bring power tariffs down to a regionally competitive level of 9-10 cents/kWh where Pakistan’s exports are competitive in international markets.

We express strong support for the Minister’s efforts on tariff restructuring and strongly urge him to expedite this process to stimulate the export sector and prevent further deterioration of the economy.