On-demand, automated no-sew systems like CreateMe’s can realistically bring some apparel manufacturing back to the U.S., but not mass fashion as we know it. The biggest wins are in speed-critical, customization-heavy, labor-intensive categories where traditional offshore sewing is weakest.

Below is a structured assessment of why this matters, where it works, and where limits remain.

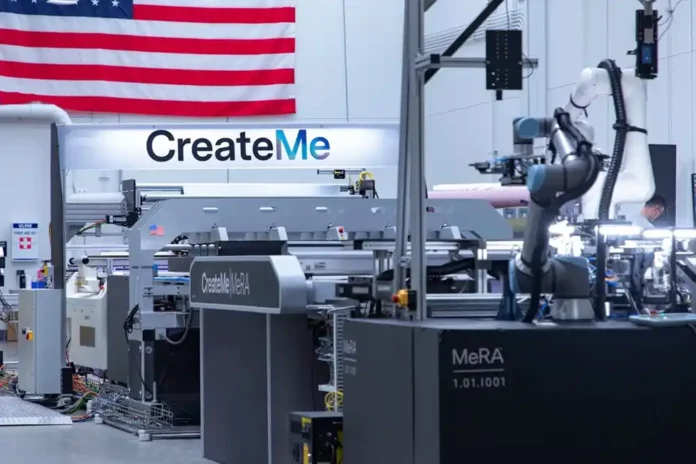

What CreateMe is actually changing

CreateMe has developed a Modular-engineering Robotic Assembly system (MeRA™) that replaces sewing with micro-adhesive bonding (Pixel™).

This is not incremental automation—it removes sewing itself, the most labor-intensive, offshoring-dependent step in apparel.

Key technical shifts

- No thread, no seam tape → bonded seams <1 mm

- Robotics + CNC precision instead of skilled sewing labor

- End-to-end automation (already proven in intimates)

- Design-to-production compression: months → days

- Clean material separation → improved recyclability

In effect, CreateMe is doing for apparel what surface-mount technology did for electronics: redesigning the product so it can be automated.

Why this can enable U.S. reshoring (in parts)

- Labor arbitrage collapses

Sewing is why apparel offshored.

If sewing disappears, wage differentials matter far less.

CreateMe claims:

- 20× faster than manual sewing

- 1,200 sq ft footprint for a T-shirt line

- Cost-competitive with offshore production by end-2026

That puts U.S. production back into contention—without needing cheap labor.

- Speed becomes the competitive weapon

Offshore apparel economics depend on:

- Forecasting

- Volume

- Long lead times

Automated no-sew enables:

- On-demand production

- Micro-batches

- Local replenishment

- Rapid trend response

This aligns perfectly with:

- E-commerce

- DTC brands

- Corporate uniforms

- Intimates

- Performance basics

In these segments, speed > labor cost.

- Sustainability and regulation favor it

Bonded construction:

- Eliminates thread (often polyester contamination)

- Enables cleaner end-of-life separation

- Cuts transport emissions

- Reduces overproduction

As EPR, recyclability, and Scope 3 pressure increase, localized, low-waste production becomes a compliance asset—not just a cost decision.

Where it will work first (very important)

Strong candidates for reshoring

- Intimates & underwear ✅ (already proven)

- T-shirts & basics (pilot in 2026)

- Athleisure / performance wear

- Uniforms & workwear

- Medical & technical textiles

- Automotive seating & interiors (major interest already)

These categories value:

- Consistency

- Fit precision

- Seam comfort

- Rapid turnaround

Where it will not replace offshore sewing (yet)

- Fashion-heavy woven garments

- Complex tailored apparel

- High-embellishment styles

- Ultra-low-cost fast fashion

Traditional sewing will still dominate style-driven, labor-dense fashion for years.

The strategic implication (the real story)

This is not “bringing apparel back” in the old sense.

It is creating a new manufacturing geography:

- Fewer mega-factories

- More distributed micro-factories

- Located near consumers

- Producing fewer SKUs, faster, with higher margins

Think:

Apparel manufacturing as a service layer, not a distant supply chain.

Bottom line

On-demand, automated no-sew production will not reshore all apparel—but it absolutely can reshore the most strategic, time-sensitive, and margin-critical categories.

CreateMe’s approach works because it doesn’t automate the old system—it redesigns the garment for automation.

That is exactly how reshoring becomes economically credible.

If you want, I can:

- Map which U.S. brands are best positioned to adopt this

- Compare no-sew vs sewing economics side-by-side

- Analyze implications for Pakistan, Bangladesh, and Vietnam

- Explore what this means for future textile design & fiber selection