The COVID-19 pandemic has turned the cotton world upside down, but not everything has changed in the past six months. China and the United States, for example, have suffered from the virus like every other country recently — and continued to batter each other with tariffs, as well — but they will remain the world’s largest cotton importer and exporter, respectively.

Although Phase One of their trade agreement went into effect on 20 February, the cotton industry had already seen several changes as a result of the troubles:

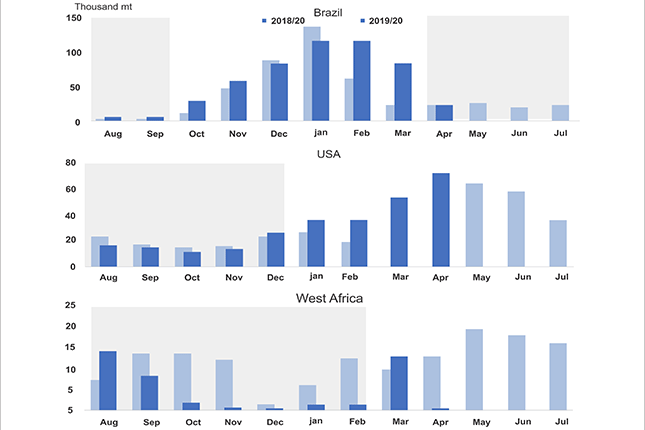

Brazil has been the prime beneficiary of the USA’s losses in China, as the South American country saw its share of the Chinese import market increase by 170% in 2018/19. The news isn’t all bad for the USA, which is still expected to export 3 million tonnes globally in 2019/20 and from August through April saw its shipments to China reach 277,000 tonnes, up 29% from the previous period.

For the 2019/20 season, most other countries are expected to find their shipments to China decrease, with West Africa’s exports declining by 48% and other countries that export to China seeing contractions ranging from 7% to 73%.

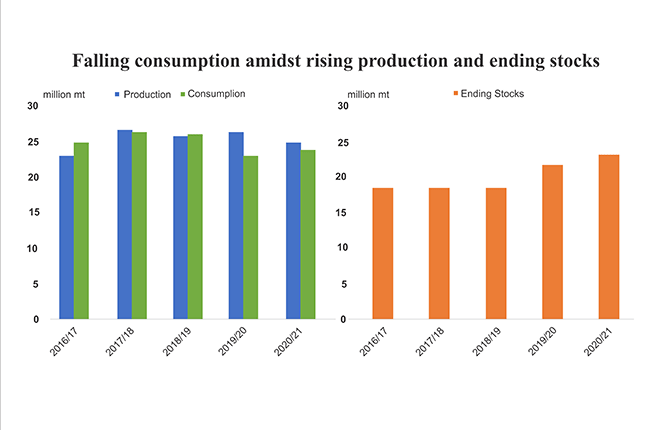

In terms of global consumption for 2019/20 is expected to be 23 million tonnes, an 11.3% decrease from the previous season. With global production expected for 2019/20 at 26.2 million tonnes, a 2% increase from the previous season, ending stock levels are expected to increase to 21.75 million tonnes, the highest level in the past five seasons.

In terms of global consumption for 2019/20 is expected to be 23 million tonnes, an 11.3% decrease from the previous season. With global production expected for 2019/20 at 26.2 million tonnes, a 2% increase from the previous season, ending stock levels are expected to increase to 21.75 million tonnes, the highest level in the past five seasons.

In terms of prices, The Secretariat’s current projection for the year-end 2019/20 average of the A Index has been revised to 71 cents per pound this month. The price projection for the year-end 2020/21 average of the A Index is 58 cents per pound this month.

In terms of prices, The Secretariat’s current projection for the year-end 2019/20 average of the A Index has been revised to 71 cents per pound this month. The price projection for the year-end 2020/21 average of the A Index is 58 cents per pound this month.